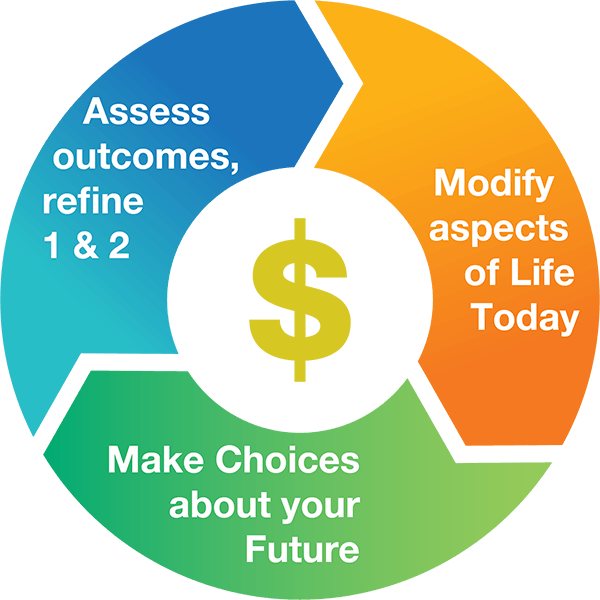

No matter how detailed or comprehensive your plan is, it will never really be done in your lifetime. Time and life will continue to march on, your thoughts for the future will change, your life today will encounter unexpected detours, and the world we live in will evolve in ways none of us can imagine.

The objective of building a plan is to allow you to make a determination of where you think you want to go and understand, if ceteris paribus (all else being equal) were to unfold as expected, would you be happy with the result.

Our planning tools are there 24/7 and your plan is a like a living document that should evolve and change.